‘The implementation of this taxation project comes at the right time in Ghana. It will contribute to the success of the concept of ‘Ghana Beyond Aid.’

Mr. Kwamena Duncan,

Hon. Central Regional Minister

‘We are happy TREE addresses the numerous revenue mobilization challenges we have, like inadequate data management; lack of enforcement of revenues not paid; poor communication between Assemblies and rate payers, and revenue leakages as a result of manual handling of revenue issues.’

Ms. Dorothy Onny,

Director of Research, Statistics and Information Management at the Ministry of Local Government and Rural Development in Ghana.

building more effective public administration by strengthening

local government

Featured Project

Ghana, Tax for Development

(TREE)

Where to start? That is the main question in many countries when addressing the improvement of local tax collection. On the one hand: taxation is needed to deliver services that make a difference in people’s daily lives. That implies that as much as possible tax invoices have to be delivered to those who can afford to pay. At the same time, those services need to be delivered so that people see that they get value for money. Where to start is then the question.

In 33 local governments in Ghana the answer was to enhance local revenue collection by focusing on improvements in the internal processes. Together with our local partner MAPLE Consult and in close consultation with the Ministry of Finance and the Ministry of Local Government and Rural Development new paths in tax collection have been taken.

Results include:

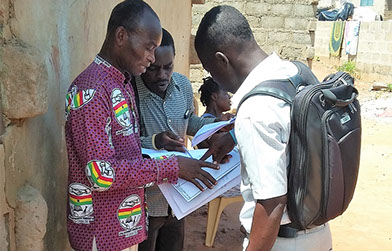

- A smart way of data collection was introduced that increased the figure of assessed tax payers dramatically. Also, electronic billing and payments were made possible that will reduce leakages in the system because all payments are traceable.

- To enhance the data collection smart phones were provided with software specifically developed for the project. On average, a tax collector in the pilot area in Cape Coast was able to enter 65 taxable objects in one day. 90% of them preferred to receive an e-bill and to pay electronically. Also 90% of the taxable objects were never registered before. Ten collectors were in the field and collected together 7,800 new data in one week.

- Enhancing the collection process is just one side of the coin. Transparency and being accountable for the spending of the increased budgets is of importance as well. Communication strategies were implemented and increased people’s awareness of the importance of paying taxes. Radio jingles were broadcasted at the time the tax invoices were delivered. In the coming months meetings will be organized for discussions about the priority issues for which the increased budgets should be used in electoral zones – the zones in which people vote for their candidate in the council.

- For the tax payers ‘the proof of the pudding will be in the eating’. The ability to deliver services that make a difference in people’s daily lives, will determine the continued willingness to pay and thereby the sustainability of local taxation. Next year a new round of local tax invoicing and decision-making about public spending will take place, building on the experiences gained now.